In January 2022, about 98% of all the premium bond prizes paid out by NS&I were just £25. You were lucky if you even won that amount, as the odds of any prize in the monthly draw were 1 in 34,500. At the time, NS&I was dealing with a problem posed by ultra-low interest rates. Its prize fund rate had been cut to 1.0% in December 2020, but it did not want to forgo its two £1 million prize winners each month, so there was less money available for other prizes. The result was the near ubiquitous £25 win.

Over 2022, as interest rates rose, the prize picture changed. In December, NS&I announced its third premium bond prize rate increase of the year, taking effect from the start of 2023:

- The prize rate is now 3.00%;

- The chances of a win at the monthly draw are 1 in 24,000; and

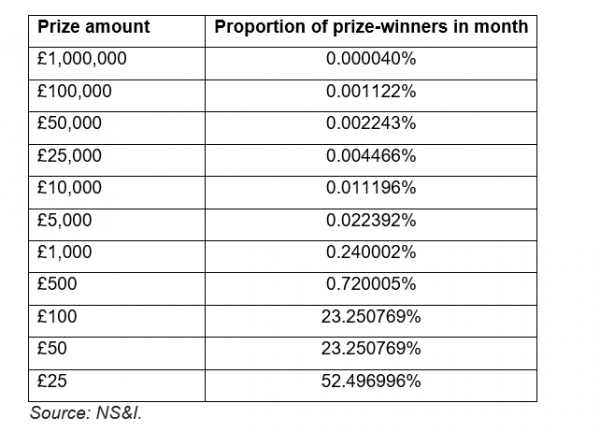

- Only just over half of all prizes will be £25. However, 99% of the prizes will be £100 or less, as the table below shows.

Nearly £120 billion was invested in premium bonds as of 31 March 2022 according to the most recent NS&I accounts – about 58% of all NS&I’s funds. They are by far NS&I’s best-selling product – were it not for premium bond sales NS&I would have seen a £5.66 billion cash outflow in 2021/22.

It is debatable whether premium bonds are a good home for savings. The 3.00% prize interest rate is better than what NS&I offers on its other variable interest rate products (e.g. 2.32% annual equivalent rate for Income Bonds and only 1.75% on the Direct ISA) and the prizes tax free. But:

- The personal savings allowance (£1,000 a tax year for basic rate taxpayers and £500 for higher rate taxpayers) means many people do not pay tax on interest; and

- The brain-numbing mathematics that underlie the prize draw mechanism lead to the average bondholder seeing a return below the prize rate. The smaller your holding, the greater the likelihood that your winnings over a year will be nil.

The maximum investment in premium bonds is £50,000, but if you are considering placing anything like that sum of money in bonds, you would be well advised to seek financial advice before placing your trust in Electronic Random Number Indicator Equipment (ERNIE).

The Financial Conduct Authority does not regulate tax advice and cash deposits.

Tax treatment varies according to individual circumstances and is subject to change.