The new state pension, payable to eligible individuals who reached their State Pension age after 5 April 2016, will rise by 10.1% to £203.85 a week in April 2023 – that is £10,600 a year. The increase is once again in line with the Triple Lock, which uprates the main state pensions by the greatest of:

- consumer price index (CPI) inflation;

- earnings growth; and

- 2.5%.

Of all three indicators, CPI was the clear winner this time around, as earnings have failed to keep pace with soaring price inflation.

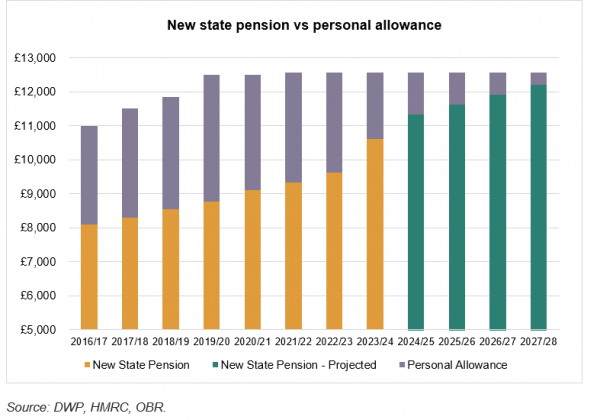

While many other state benefits will also grow by 10.1%, the mirroring of inflation by the DWP is not matched by another government department – HMRC. The personal allowance will stay at £12,570 in April 2023, remaining at its two-year-old frozen level. It was due to start rising again from April 2026, but the Chancellor’s latest Autumn Statement added another two years to that date, meaning the personal allowance will be frozen up to and including 2027/28 – a total freeze of six tax years.

The impact of that lengthy ice age is demonstrated in the chart above. What this shows is the new state pension from when it began in 2016/17 to 2023/24 (orange) and the Office for Budget Responsibility’s (OBR) projections for the level over the following four years (green). The purple element shows the gap between the personal allowance and state pension in each tax year. In 2019/20, the personal allowance was over £3,700 higher than the new state pension.

If – a big if – the OBR’s crystal ball is wholly accurate, then by 2027/28 the difference will be about £360 – less than a tenth as much. The OBR’s estimate only needs to undershoot by 0.8% a year for the new state pension to be larger than the personal allowance in 2027/28. That could cause problems for HMRC, because although the state pension is taxable, it is paid without deduction of tax.

Of course, it may not happen – 2027/28 is well after the next election, for a start. However, it is a reminder both of how the income tax screw is being turned tighter and why income tax planning is becoming ever more important.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax or benefit advice.